Dubai Office Market 2025: Scarcity Turns Offices Into Gold

Dubai’s office market in 2025 has become one of the most dynamic in the Gulf. Robust demand collides with limited supply, creating substantial growth in rents, sales, and investor appetite. Both CBRE and Knight Frank data confirm that scarcity has become the key driver of value. For investors, the result is clear: Dubai offices represent one of the sharpest opportunities of the decade.

Demand From Every Direction

Dubai is now a magnet for global business. Demand does not come from a single sector but from across industries. In H1 2025, business services accounted for 38% of total office requirements. Technology firms added 31%.

Real estate companies contributed 12%, banking and finance 10%, healthcare 4%, logistics 4%, and retail 1%. Together, these sectors form a balanced tenant base. Multinationals and regional firms alike are consolidating into premium space, often pre-leasing before completion.

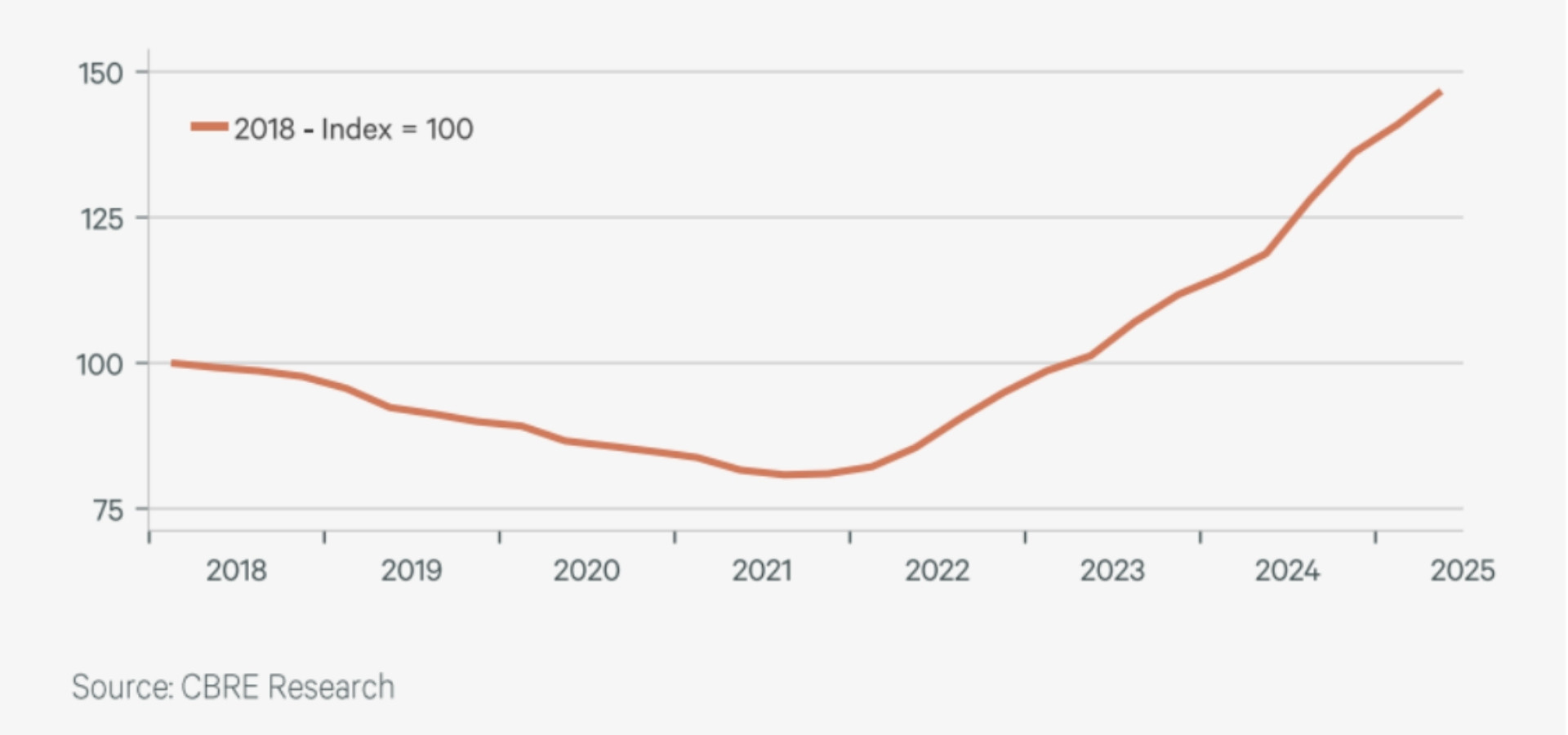

Rents Push to New Heights

Strong demand and scarce supply keep pushing rents upward. DIFC remains the most expensive submarket at AED 400 per square foot. Dubai Design District averages AED 280, The Greens AED 260, and Business Bay AED 251.

Across the city, prime office rents rose 23% year on year in Q2 2025. Tenants renewing leases face fewer options and higher costs.

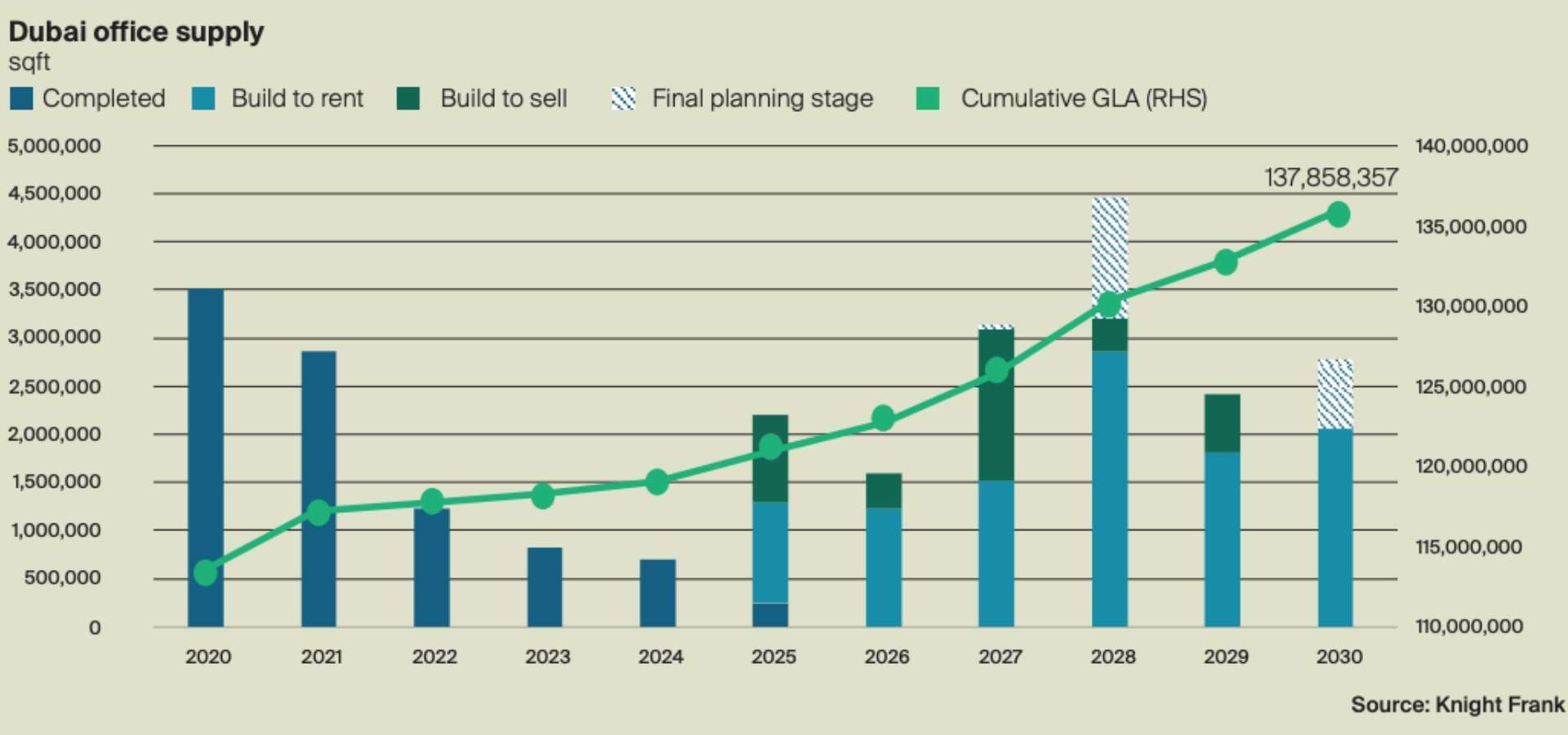

Tight Supply and New Launches

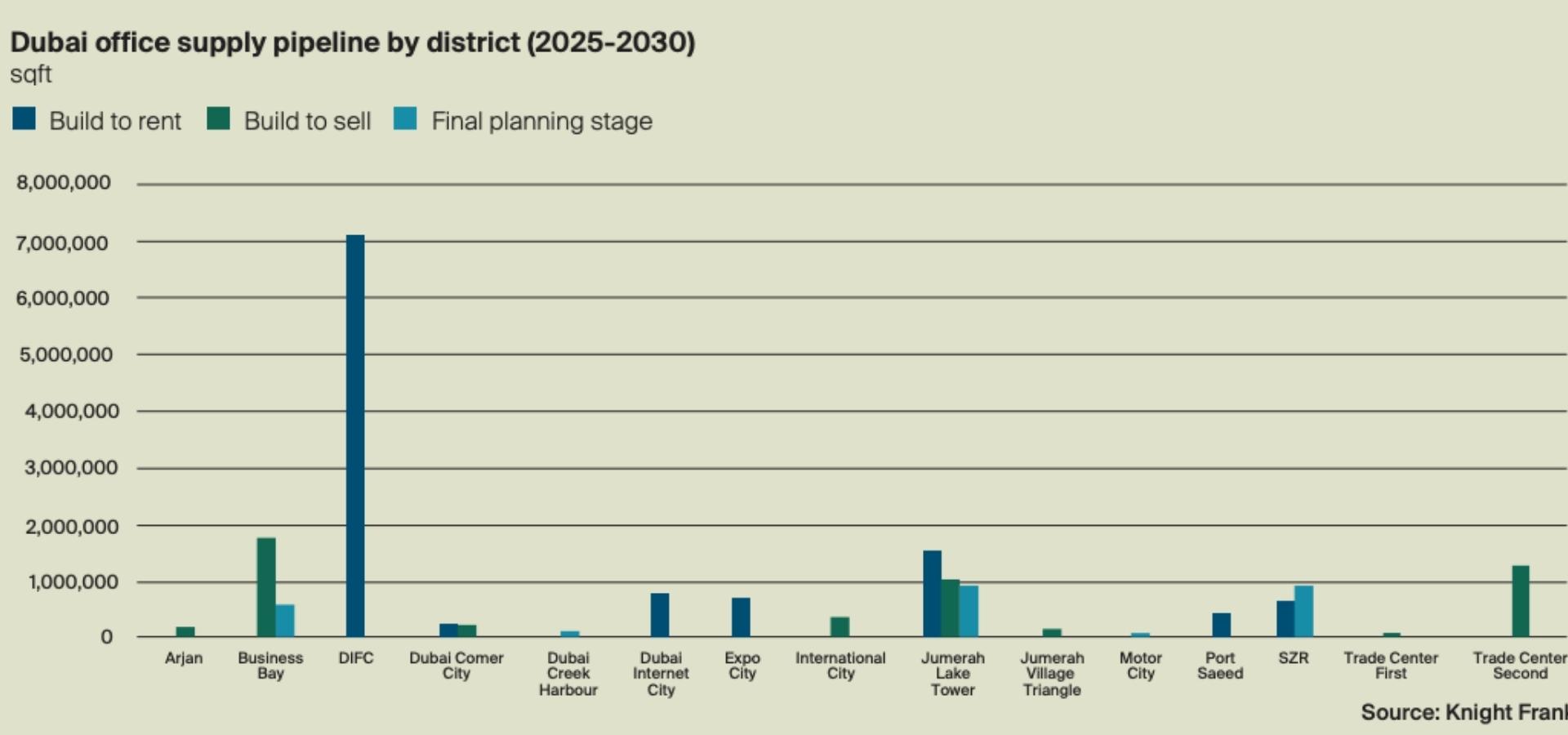

Only 1.3 million square feet of new offices are expected in 2025, including Innovation Hub Phase II and Dubai CommerCity. New launches such as Lumena and Enara in Business Bay and Dubailand show developer appetite for niche segments. Still, availability is thin. Occupancy rates reached 94% by mid-2025, up from 92% in 2024. Developers are responding with ambitious pipelines. By 2030, Dubai’s total office stock will expand by 15.8 million square feet to nearly 138 million square feet.

DIFC accounts for more than 7 million square feet, largely built to rent. Business Bay will deliver 1.3 million square feet under build-to-sell schemes. These strategies reflect both investor appetite and developer preference for stable income.

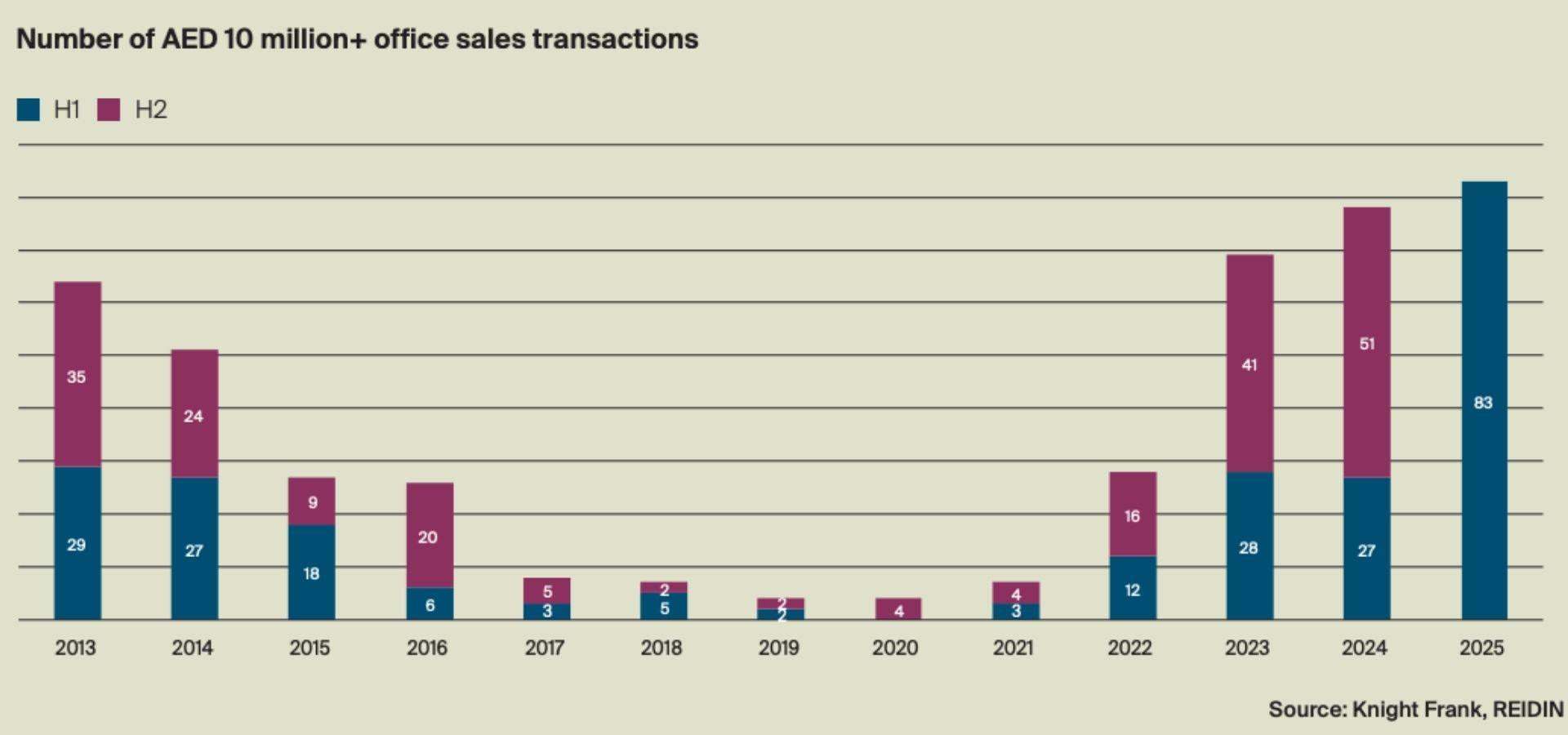

Record Sales and Rising Values

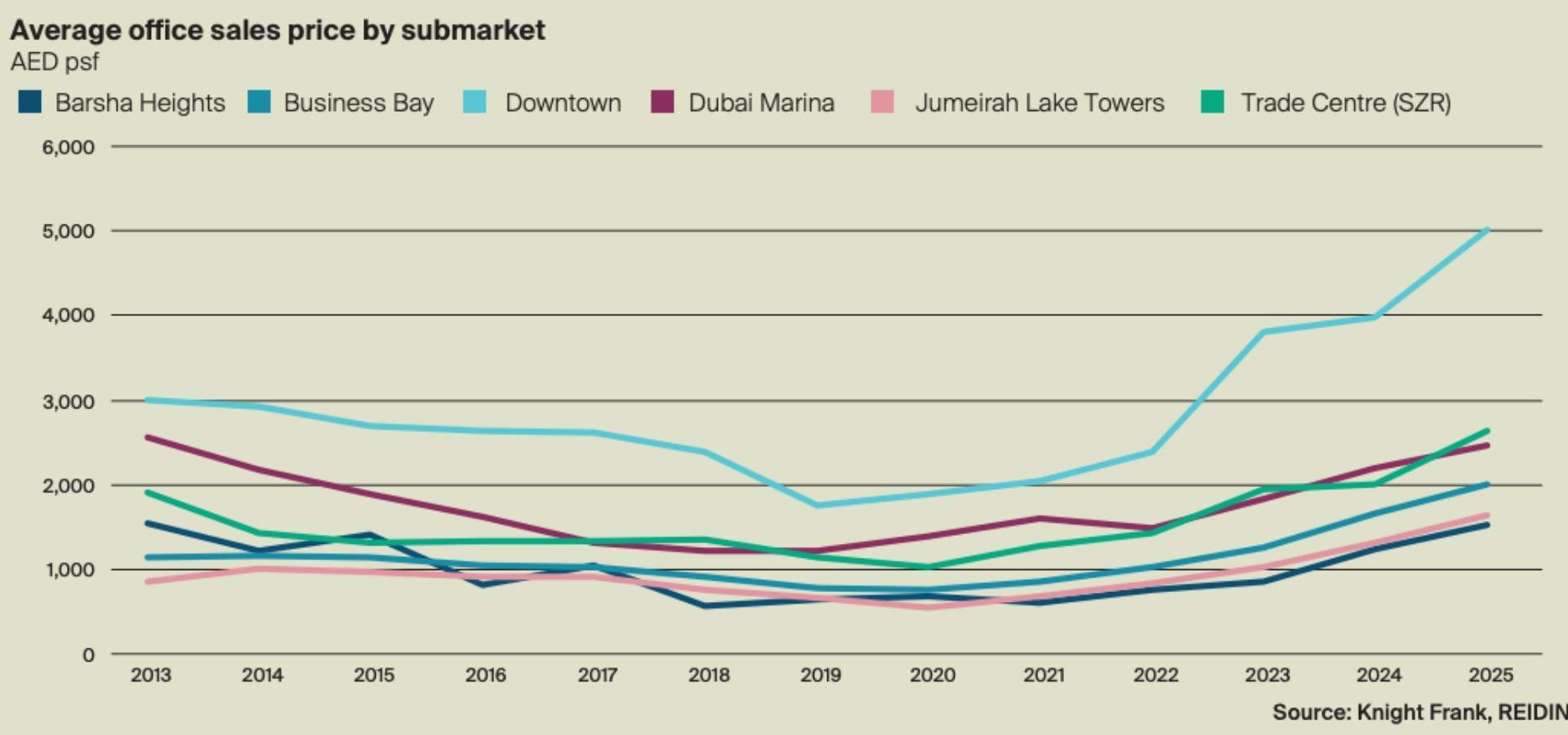

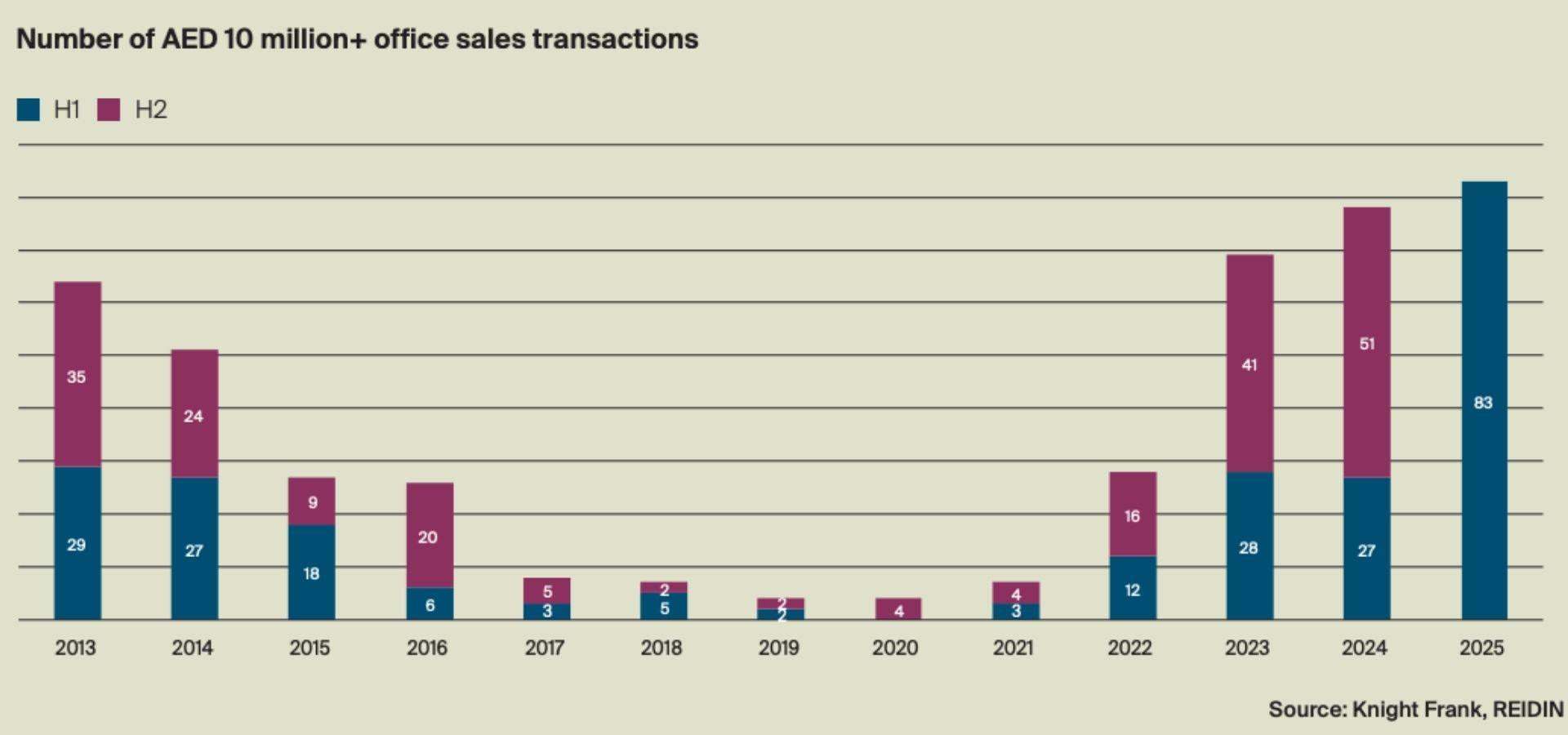

Investor activity mirrors the strength of leasing demand. Downtown Dubai offices now average above AED 5,000 per square foot. Business Bay shows remarkable appreciation, with a compound annual growth rate of 21.2% since 2020. High-value sales also surged. H1 2025 recorded 83 office transactions above AED 10 million, compared with 27 in H1 2024. This reflects growing confidence in Dubai’s role as a safe haven for capital.

DIFC Anchors Dubai’s Growth

The DIFC continues to anchor the city’s global appeal. In H1 2025, it registered 1,081 new companies, raising the total number of active firms to 7,700.

Insurance premiums rose 34.6% year on year to US$3.5 billion. Banking and capital market firms grew 17%, while wealth and asset managers expanded by nearly 19%.

Such growth cements DIFC’s reputation as the Gulf’s leading financial hub. For investors, properties here offer unmatched prestige and stable appreciation.

Outlook: Scarcity Becomes the Opportunity

For the rest of 2025 and beyond, demand will continue to outpace supply. Pre-leasing for landmark projects scheduled between 2026 and 2028 already signals strong sentiment. The flight to quality trend will widen the gap between premium Grade A offices and older stock.

For investors, the case is clear. Limited availability ensures rents will climb, while capital values appreciate.

Why Invest in Dubai Offices?

- Demand surpasses supply, creating landlord-friendly conditions.

- Rental growth ensures attractive yields.

- Prime districts offer strong capital appreciation.

- A rich pipeline sustains long-term expansion.

Data Summary |

||

| Metric | Figure | Source |

| Office rental growth | 23% YoY | CBRE Q2 2025 |

| Office occupancy rate | 94% mid-2025 | CBRE Q2 2025 |

| New office stock by 2030 | 15.8 million sq ft | Knight Frank H1 2025 |

| DIFC new office supply | 7 million sq ft | Knight Frank H1 2025 |

| Business Bay new supply | 1.3 million sqft | Knight Frank H1 2025 |

| Highest office sale price | Over AED 5,000 psf | Knight Frank H1 2025 |

| Office sales over AED 10 million | 83 deals in H1 2025 | Knight Frank H1 2025 |

| DIFC company registrations | 1,081 new in H1 2025 | Knight Frank H1 2025 |

| Growth in insurance premiums | +34.6% y-o-y | Knight Frank H1 2025 |

| Growth in banking/asset firms | +17% and +18.9% y-o-y | Knight Frank H1 2025 |

Conclusion:

Dubai’s office property market is not only resilient but thriving. Strong business confidence, limited supply, rising rents, record sales, and an ambitious pipeline place Dubai at the forefront of global real estate. For investors, this market offers both immediate rewards and long-term security.